Planning and Allocating Resources (Summer 2022 Edition)

This is Part 5 of a 5-Part Series, tied to our publication of the PCG Calculator.

Perhaps you were lucky enough to have raised several years of runway at the end of 2021, to give you enough time to grow into your valuation even in a tight market, so that you can raise a healthy next round in the next 12-18 months. That’s the best possible situation.

Or, you might fall into the unlucky bucket of having raised in early 2021 with a rich valuation, finding yourself with <6 months of runway in the summer of 2022. Not only would that valuation seem inflated in retrospect, but the expectations for what you look like today is much higher, too.

Like most companies, you might be somewhere in the middle. You might still have 12-24 months of runway, which means that you don’t need to raise right away (phew); but you still have a much higher bar to clear in the next 3-6 months to have a not-awful experience raising at a reasonable or healthy valuation (oof).

Thoughtful Reads from Others

If you want to consider the range of measures you might take today, take a look at this excellent FAQ for founders by Pulley. In summary: assess and act decisively; make different decisions depending on whether you have <6 months vs. 12-24 months vs. 24+ months; and make different decisions if you’re pre vs. post PMF. These are really important dimensions to consider! Too much advice out there is generic and lacks nuance. There’s also spot-on advice regarding dilution, time horizons, seizing opportunities, and managing your psyche.

Also worth reviewing various balanced takes like:

- Ali Partovi’s pithy and spot-on You can’t save your way to becoming a unicorn

- Sam Lessin (Slow Ventures) pointing out that “You should have 36 Months of Runway” [is] simplistic and misses the point.

- David Sacks’ (Craft Ventures) framework of “default investable“ [rather than] “default alive”

Most recently, Hunter Walk’s blog post that Not Every Startup [should] ‘Pull the Brakes’ Just Yet is an excellent read. It takes a deeply thoughtful tack to compressing multiples tied to margin and growth rate (unsurprisingly, ties right into the PCG multiple!), marks distinct strategies based on your customers (tech companies vs. other industries), considers whether exit expectations have reset permanently to unicorn rather than decacorn, and touches on the psychology of crossover investors.

A Framework for Making Decisions

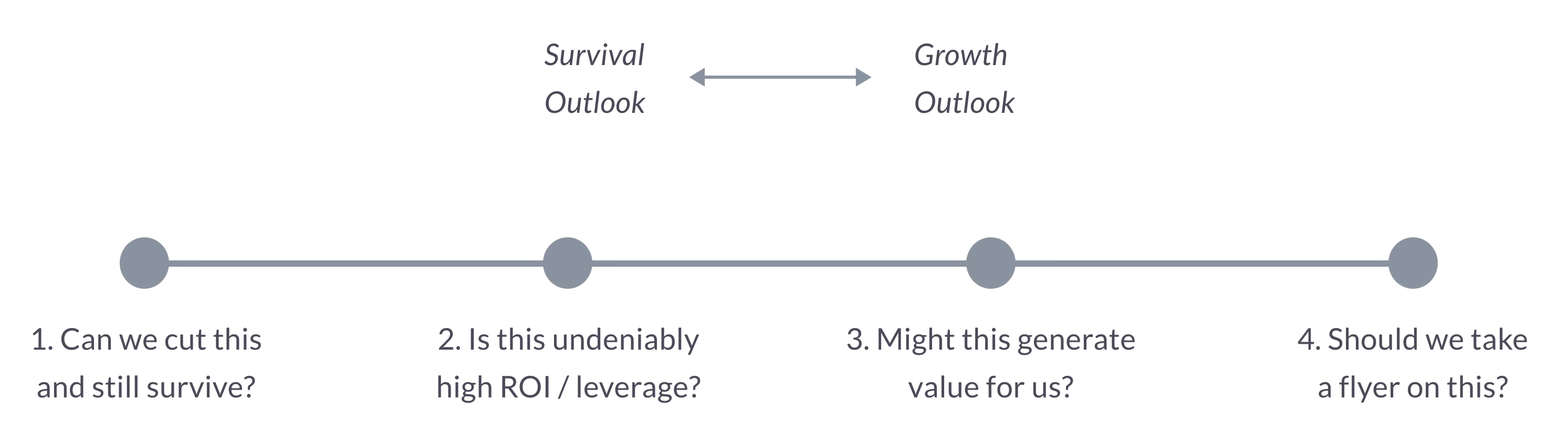

There’s one thing we’d add to the mix, which is a framework for how decisively and differently you should to act. There is a spectrum for how to assess any decision — a hire, a project, a vendor, you name it. And your willingness to invest in / keep / cut that resource or initiative should tie to which mode you’re operating in.

4. Should we take a flyer on this? This is unsustainable bull market mentality, and honestly how many startups have operated in the last few years. It’s somewhat understandable; if there’s an unceasing spigot of capital, you’re in a “growth at all costs” mindset = mode #4. There’s also a mathematical tie-in back to the PCG model. If your growth rate is an exponentially valuable factor in your valuation, it seems logical that you should invest (excessively) in growth, no matter what.

3. Might this move the needle for us? This is an abundance mentality, and how good startups operate in a very healthy market (such as 2020-21). They are willing to place bets fairly freely, but not being frivolous. It is certainly not efficient, but it is not wasteful, either. However, seasoned / serial entrepreneurs who were operating in this mode resourced themselves accordingly — raising for 24-30+ months, not 12-18 months. Because winter is coming.

2. Is this clearly high ROI or high leverage? This is a much more disciplined mindset, and how startups have operated historically prior to 2019. You still place bets, but very cautiously. This is the absolute minimum for where startups should be operating in 2022. Even if you have 24+ months of runway, you probably want to take a second or third look at every place you’re allocating capital or resources.

1. Do we absolutely need this to stay alive? This is scarcity mentality, when you’re worried about surviving, not thriving. This is how startups operate if they are are “default dead”, or “default uninvestable,” or have raised at unsustainable valuations that they’ll need years to grow into (in a bear market). This should be the mindset if you have <12 months of runway.

So... What's Happening Today?

In the venture ecosystem, if you’re paying attention, the sentiment you’re hearing is the pendulum swinging from #4 (flyer mode) to #1 (survival mode)… some of which is an overcorrection.

If you were operating in #4, you should probably swing hard to #1, no matter how much runway you have… because there’s probably a bunch of bloat in your company. This is what you’re seeing with many companies that have plenty of cushion still deciding to make cuts. Once these cuts are made, they will probably settle in around #2.

If you were operating in #3 so far:

- If you have 12-24+ months of runway, you should definitely still swing to #2: focus on operational efficiency, exercise more caution. But still take advantage of your room and runway to invest in the highest ROI things. But to go to #1 (cut cut cut) would be an overcorrection.

- If you have 36+ months of runway, you might be able to stay in #3 (i.e., be more aggressive, invest more opportunistically) for a little while longer, but keep an eye out.

If you were operating in #2

- If you have 12-18+ months, then you might make some changes on the margin but it’s probably fine to stay the course. Keep working towards PMF or keep investing in growth.

- If you have 24+ months of runway, this may be (counterintuitively) a time to get aggressive and move to #3 — for example, with talent.

If you have <9 months of runway, you need to swing to #1, no matter where you were operating before.

In Conclusion

This shift in decision-making and operating is part of the “reversion to the mean” that many VCs are referring to. Most startups will settle in and operate at #2 (focusing on the highest ROI things... which is honestly the right steady state place to be in, anyway).

Finally… if you’re an early stage startup, yet another reminder that you’re building something on a decade+ horizon. As many have pointed out, generational companies are built in the depths of a recession (the last one produced Airbnb, Stripe, Square, etc.). This is especially because rocky market conditions with a small denominator doesn’t affect you that much. Growth-stage companies that are trying to double starting from $100M in ARR are in a tough spot, but if you’re starting from $1M, it’s going to be harder than you might have planned for… but it’ll be a heckuva lot easier than the growth stage company.

Inch by inch, step by step, move the ball forward. Grow your business, hire and retain great talent, keep an eye on operational efficiency. Valuations will take care of themselves.

Access all parts of our Startup Valuations & Fundraising: Summer 2022 series below:

Part 1: Startup Valuations & Fundraising

Part 2: The Flavors of Fundraising

Part 3: How Should I Value my Startup?