April Newsletter

🚀 What’s New

Bi-weekly status digests with open + recent items; Ability to process deregistrations, zero-filings, mailing / name / DBA updates right in the platform; and proactive compliance monitoring & auto-resolution of snail mail and email for Core customers.

🇺🇸 State Compliance

Bi-weekly compliance status digests

We know it can be challenging to keep up with the status of your registrations and compliance issues, which is why we are now sending out a bi-weekly digest to keep you informed about the status of open compliance issues and registrations and recently resolved ones. This will help you stay up-to-date with any compliance gaps that need to be addressed.

Any feedback or other things you'd like to see in this email? Let us know.

An Example of what you'll see in our Digest:

Please see below for the latest open and recently resolved issues!

Registrations:

- Washington state registration application (created 2023-03-02) is done! ✅

- California state registration application (created 2023-03-20) is done! ✅

- Illinois state registration application (created 2023-04-28) needs your action❗

Issues:

- Nevada DOL Notice .jpeg (created 2023-04-02) is awaiting a response from the state ⏰

- Issue for The Bluth Company - WA credit notice - Apr 06 2023.pdf (created 2023-04-07) needs your action❗

- Issue for The Bluth Company - main_annual-report-newyork - March 07 2023.pdf (created 2023-03-07) is on our plate 💁

Please log into your dashboard if you'd like to review these in more detail or take action!

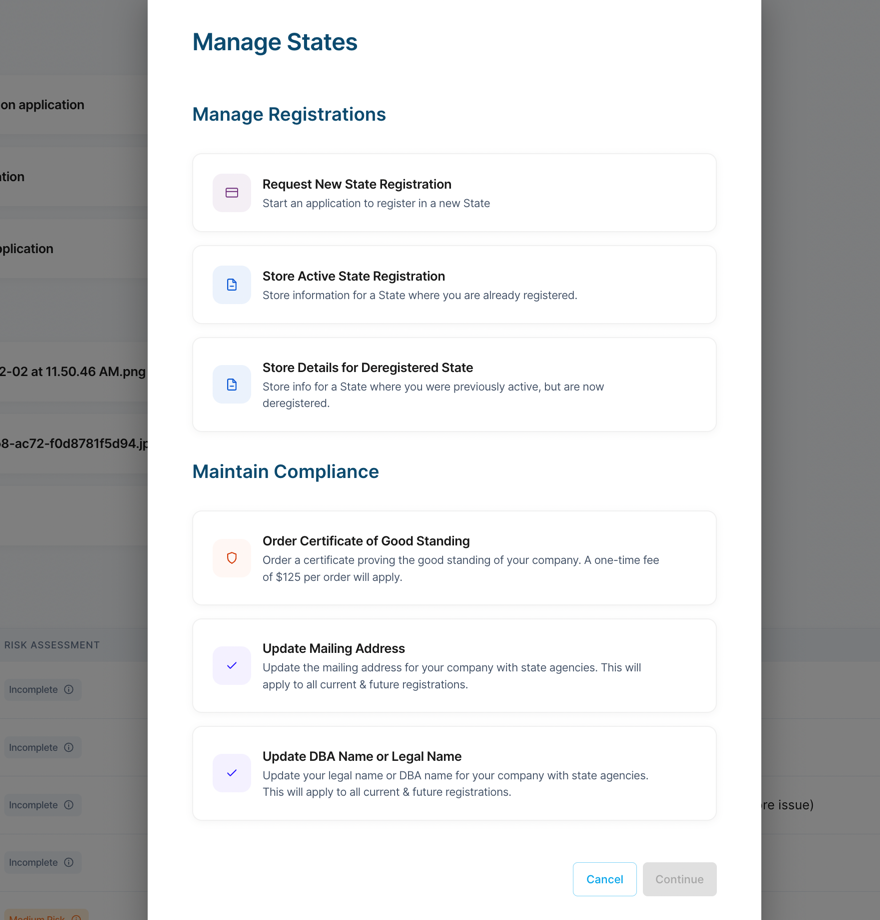

Manage your States with Ease

We have further streamlined the process of completing a variety of registrations and other compliance needs. Click on "Manage States" at the top right corner of your Dashboard and pick from the menu.

Our favorite? Keeping your state records up to date is super seamless. Core customers can request an update to their mailing address, DBA name and more with just a few clicks!

Deregister with Ease

If you no longer have employees in a state, you might want to deregister. We are excited to share that you can now deregister in a state within a few minutes. Simply navigate to the state and click on Registration Actions. If you've already deregistered yourself, you can mark a state as such to maintain records.

There are various reasons why a business might need to deregister from a state's payroll, including but not limited to: ceasing operations in the state, having no active employees in the state, or selling or dissolving the business.

Learn more about the deregistration process here.

Auto-review of snail mail + emails from states

So far, Core customers who sent in a notice for action would receive an email back asking if the file needed action. We got a lot of feedback that users didn't always know (or have the time!) to request review.

So we took that off your cognitive load too. Every file that hits our system is reviewed by a combination of software and experts, and if something needs attention, it's simply done! You're only looped in if your input is needed, or if it's an item that's out of scope for us (e.g., sales tax or income tax issues that your CPA probably handles). And if you don't have a virtual mailbox? We'll set one up for you, at no cost.

But wait – states also sometimes send notices by email. What about those?

We took care of those too! Any emails from states are specifically recognized, turned into a PDF (for good recordkeeping in your Documents page), and resolved, just like snail mail.

Core customers literally never have to think about payroll tax notifications, ever again. To make sure we're in the flow of these files, please make sure we have access to logins for all state portals that AO manages for you.

💡 Tips & Best Practices

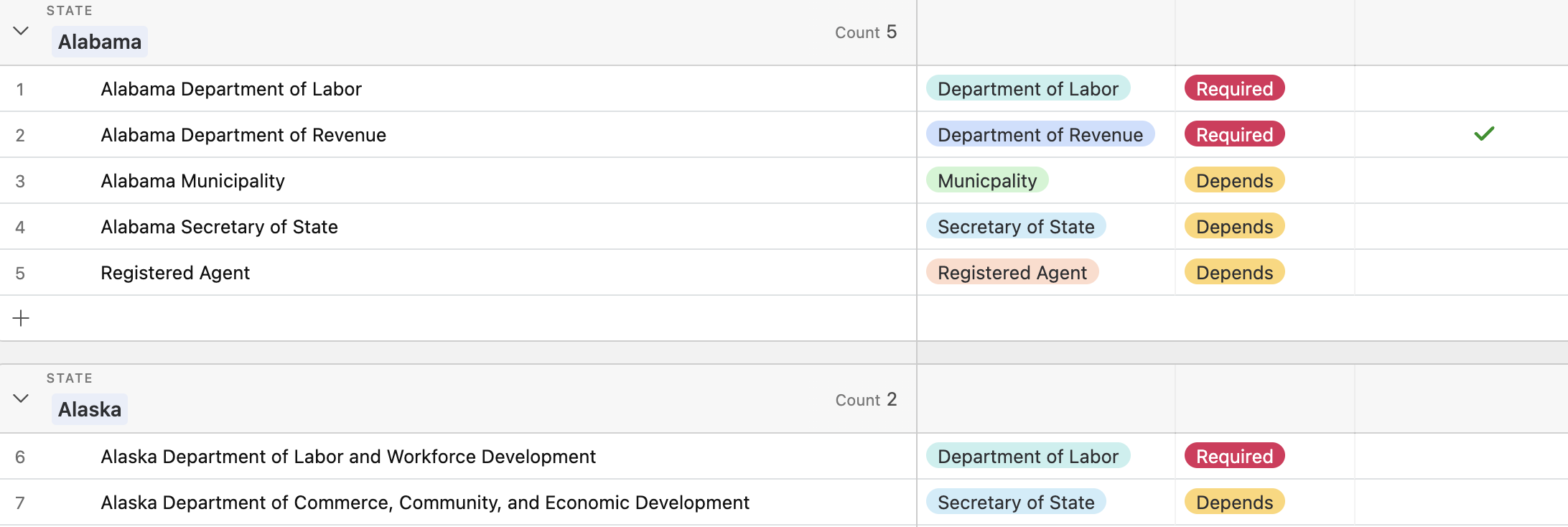

State Registration guide

We've put together a useful payroll tax registration resource so that you know current turnaround times, required departments per state, and which are payroll blockers. This should give you a sense of what to expect when considering and planning new hires and expectations.

Tax and filing season callouts

Many states require you to file an annual report in April or May. You will receive reminders in your physical/virtual mail box, along with some potential scams. If you’re unsure how to submit the report or determine the legitimacy of the notice, we’re happy to help!

Have you paid your Delaware Franchise Tax?

The Delaware franchise tax is an annual tax and filing imposed by the state of Delaware on all businesses incorporated or formed in Delaware and was due on March 1st. The amount of the tax depends on the type of business entity and the number of authorized shares or members. If you still need to file or pay the tax and need assistance, let us know!

Thanks for reading!

The AbstractOps Team

Have people in your network who might benefit from AO? Refer a Core customer and get a credit of $250 on your next invoice (and they'll get $250 off too!)